Pros & Cons of Short Sales, circa Spring 2012

May 1, 2012, by Mark Wheeler

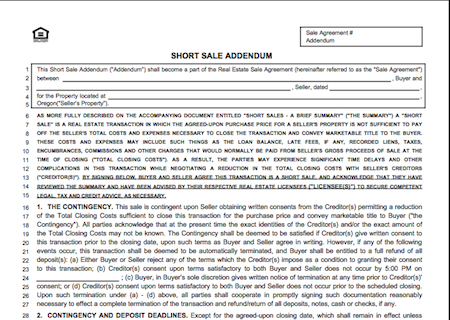

Short sale practices & procedures continue to evolve; no two short sales are the same, but there are trends. What was true last year may not still be true, and the only thing constant is change. Our local Realtor forms company, OREF, has some excellent documents that should be required reading for anyone contemplating buying a short sale in Oregon. One is a Short Sale Buyer Advisory & one is the Short Sale Addendum that we would use if you write an offer to purchase a short sale property.

Since these documents recommend the buyer seek legal counsel, we are often asked, “why do I need an attorney when buying a short sale?” I am not an attorney nor am I giving legal advice, but here’s my take on it.

The biggest legal issues for a buyer of a short sale are typically along the lines of “how can I proceed without more risk of time and money than I want to risk?” Since Realtors cannot interpret legal documents or give anyone legal advice, we often have to, by law, recommend folks seek legal counsel. Of course, many buyers decide not to do so. That can be a valid choice sometimes as well.

We can coach you as to what to expect. Every short sale is different and they continue to evolve as laws & practices of the banks shift. Sometimes it is possible to proceed without risking more than your time, sometimes you will be asked, or required, to put up money in order to proceed. That will depend on the lien holder’s wishes, as well as the seller. Of course as a buyer, you can choose to agree or not agree with their requests. If you don’t agree, you just move on to a different property.

The main way you would risk money is by proceeding with inspections before short sale consent is granted by the lien holders. This can be advantageous to you though. While no one wants to spend money on inspections unless they know the sale will happen, with short sales, you never really know if the sale will close until it actually closes, and you might just want to know sooner than later if the house has some fatal flaw that you are not ok with buying. The way to know about these big flaws is to have inspections. If you wait until short sale approval is granted before having inspections (many buyers do, again depending on the lien holder’s demands) you risk having wasted months waiting around for sale approval only to find out about whatever flaws that may be present. These days most buyers have several different inspections (general, sewer, radon, oil tanks, etc) and most buyers are spending close to $1000 on the various inspections.

Keep in mind short sales are generally “as is,” because a seller trying to short sale often has no money left over for repairs. So, the buyer might want to know sooner than later if there are repairs needed & to what extent & cost. Also, once short sale approval is granted, if you then try to get a discount due to repairs needed, it is typically harder to negotiate this at that time; it is typically much easier to get a discount due to needed repairs if that negotiation is done from the beginning rather than at the end of the sale.

Another way you could risk your money is regarding how earnest money gets treated. This again is up to buyer & seller to agree upon, but often buyers are requested to put up earnest money right away, just as if they were buying a non short sale. If the sale closes then your earnest money goes towards your down payment. But if you revoke your offer or the house forecloses or the short sale is denied, then the seller has to agree to release your earnest money. If the seller doesn’t cooperate, it can be a bit of a struggle to get your earnest money refunded. In the end it is likely that you would get it back, but since we don’t control your earnest money we can’t guarantee it.

Earnest money is typically held by an escrow company in Oregon. They are a neutral third party and have to have matching instructions from buyer & seller before they can release money.

Many short sales fail for a variety of reasons. It depends on the lien holders, who they are & how many of them are there. It also depends on having a motivated seller who is willing to jump through their bank’s hoops. By the time some sellers get to short sale conditions, sometimes they just give up and stop cooperating. Lastly, it depends on having a seller’s agent who knows what they’re doing. So, unless the stars align, it can be a rocky and sometimes fruitless endeavor.

So, what is the advantage of buying a short sale? Good question. Sometimes there is none. But if you are very, very patient and willing to risk your inspections fees if necessary, and the house is exactly what you want, it could work out well. Sometimes the price reflects the hassle involved, so you may pay a little less in the end.

A quick update. This post generalizes a complex process with many variables. Sometimes, the process can go quickly. I see that this week two colleagues of ours, a Buyer’s Agent Realtor & a Seller’s Agent Realtor in Portland, got an offer accepted by the seller & buyer within about 4 days, got the sale approved by the lien holder in about 3 weeks and were able to close the sale about 3 weeks later. Clearly all parties were motivated and on task. It can be done!

Please let us know if you need more info. Thanks for reading!

Follow Us